In today’s world, it is easier than ever to start your own business. The internet has made it possible for people with innovative ideas to make their dreams come true. In this blog post, we are going to discuss how you can start a successful and profitable business. We will talk about what you need to be successful and give you some tips on where to get the help that you need when starting!

How can I start a successful business with no money?

A small business can be started with just a few dollars if you know how to find the right opportunities.

Start by focusing on your skills and passions: What can you offer? Where are people looking for these things? Who might need what you have to offer, even without knowing it yet themselves?

What is something that I’m passionate about or good at doing? Can I turn this into an opportunity somehow?

Don’t let fear keep you from exploring new ideas. You may not succeed immediately (or ever), but success won’t come any faster if we don’t try! If there’s one thing businesses do well, it’s overcoming obstacles. How will mine fare against yours?

Starting an online business doesn’t need to be expensive. You don’t have to spend thousands of dollars on start-up costs, and you can probably get started with less than $100!

What are the 4 important tips in starting a business?

Conduct Market Research

Market research can help you find your competitive advantage. You need to know your customers and the competitive market.

Be patient in waiting for success

Many people want instant gratification, but this is not always realistic or possible. Patience pays off when you build something successful over time instead of rushing a project because it’s due too soon or trying to make money fast without doing enough research first. You’ll have more resources at your disposal if you wait until the timing is right before launching into business. This will reduce stress on finances and increase longevity with staying power than any other venture would lack.

Breakeven Point: The point where revenues match expenses after all fixed costs are covered

This includes rent, utilities, taxes (income tax), insurance, etc., which means an entrepreneur must calculate gross margin plus increased expenses at the breakeven point.

Take on Investors

Investors may help startups with cash flow or by providing valuable connections and advice. Decide if this is something that your business needs to consider before proceeding. It’s not for everybody, but it can be a very good idea in some cases where more capital is needed upfront to get started due to higher fixed costs associated with renting property, purchasing equipment, paying taxes (income tax), etc., while also making sure there are enough funds available after all of these initial start-up expenditures have been made so when revenue starts coming in you’re able to pay back loans or other debts incurred during startup phase as well as cover ongoing operating expenses like salaries, utilities, office supplies, etc.

Formulate a detailed business plan

A detailed written document that addresses aspects of the venture like:

– What your product or service is and how it works

– The target market, including who may purchase from you (consider their age range) as well as various geographical locations in which they reside

– How much money will be needed to get started? This includes upfront expenses for things such as startup costs, licenses, insurance requirements, and permits; monthly overhead expenditures on items such as rent/mortgage payments; payroll taxes; inventory purchases when necessary to meet customer demands; future expansion plans

– A financial forecast outlining proposed profits & losses over a period based on projected sales figures versus anticipated expenses at each stage of the growth cycle

– A marketing plan to promote your business; should include how you will reach your target customer or customers as well as what types of incentives and promotions are available for purchase. This includes where you can buy advertising space, things such as newspaper ads, website banners, and pop-up ads on other websites an individual might visit to generate leads). The goal is to get people contacting you first rather than trying to find them yourself)

– An exit strategy: What would happen if everything failed? Try constructing a race-horse mentality approach that demonstrates flexibility with various contingencies when the unexpected occurs (like needing more financing, obtaining new equipment at different times based on sales volume changes over time.)

Things to consider When Starting a Business

Your business name and business idea are not enough to start a successful business. In this article, we’re going to go over some of the things that people need to consider when starting their own small businesses and outline how they can use these considerations as a guide for everything in the future.

Business Model

Your business model will have a significant impact on your success, so it deserves careful consideration. The most common business models are SaaS (software as a service) and B-to-B and B-to-C (business to business or business to consumer).

If you sell something directly to consumers (sold items can be physical products, services, digital goods), then the final price of every item will need to cover costs for manufacturing plus all other expenses required for that product or service to exist. You may also want to consider what happens when there is an unanticipated increase in demand? If inventory levels are not managed appropriately this could lead to either stock-outs which result in lost sales or higher than expected losses if additional supplies must be ordered at the last minute.

For those with a service or digital product, it’s generally easier to forecast demand for these items and price them accordingly. If your company is focused on providing software services then you need to take into account the initial time cost required to provide that service (e.g., development costs). You will also want to consider how much ongoing support this type of business requires since clients typically pay an annual fee which ensures they have access to all updates released during that year as well as being entitled to any technical assistance when needed.

Avoid high-priced products if possible: When pricing your offerings be careful not overextending yourself by having too many expensive options available because you may struggle with orders at the other end of the spectrum.

You can also research existing companies to give you an idea of what your pricing should be.

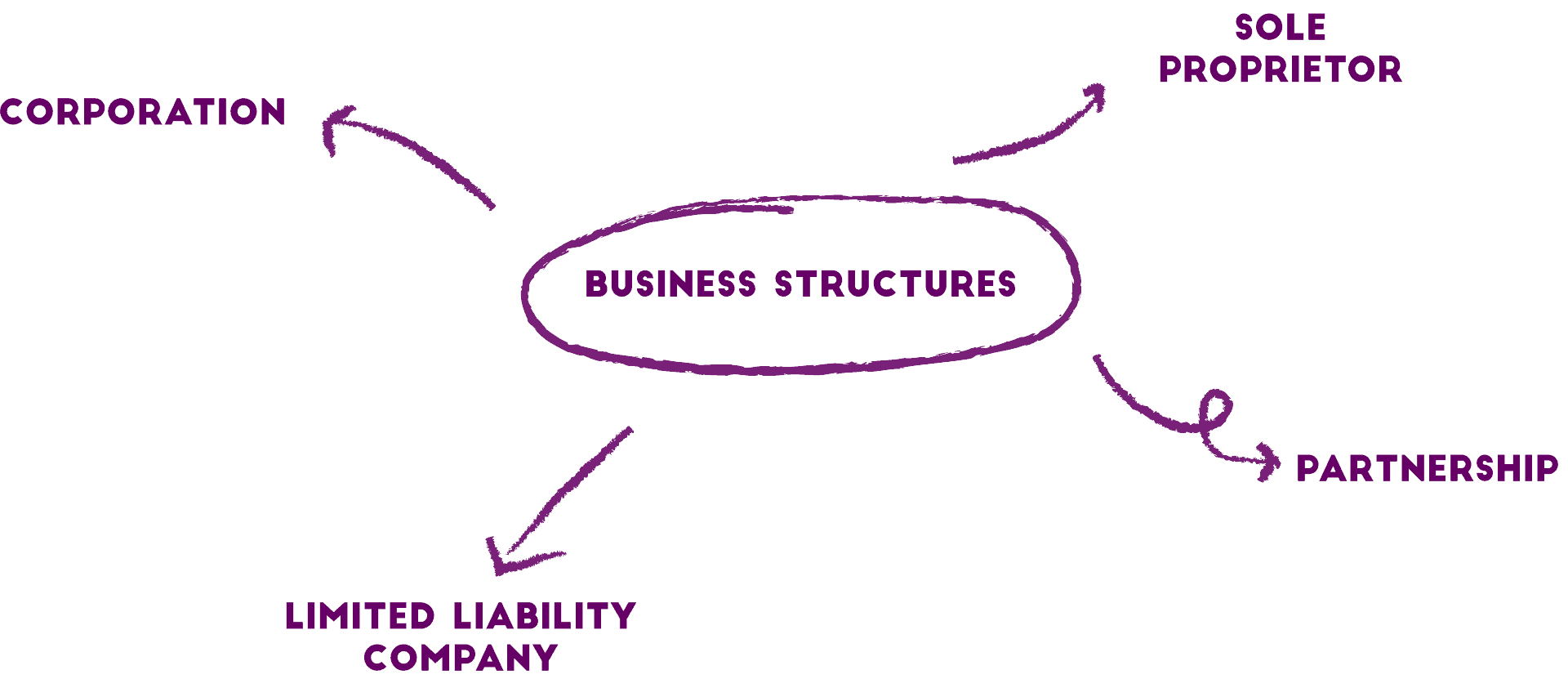

Business Structure

New businesses have two broad business structures to choose from, sole proprietorship or partnership. Partnerships are more complicated because they require agreements of the partners and should have a written contract outlining responsibilities. A partnership agreement needs to include decisions on topics like how profits will be split up, which partner(s) has control over different areas of the business, what happens if one partner wants out etc.

A sole proprietor is an individual who owns their own company by themselves; there’s no need for any kind of legal entity (limited liability company/LLC). With this structure, you can just register your name as a trading name with your state government so that it becomes legally protected against other entities using it in certain industries.

If you want more protection from lawsuits, you may want to choose a limited liability company (LLC). The LLC is like the sole proprietorship because it’s an individual and there’s no need for any kind of legal entity. But with this structure, if someone sues your business, they can only sue up until the amount that they contributed in terms of capital investment or shares.

The difference between these two structures comes down to what level of liability risk each person has. With a sole proprietorship share ownership responsibilities are completely shared among all partners; while with an LLC assets are split into different levels meaning one partner could be liable for more than another etc.

A partnership agreement needs to include decisions on topics like how profits will be split up, which partner(s) has control over different areas of the business, what happens if one partner wants out etc.

Business Plan

Business involves planning and so does starting a business. A good plan can be the difference between business success and failure.

A business plan is a document that helps you define your idea, learn about what’s needed to make it happen, and prepare for how to deal with challenges along the way. Businesses require funding to start up properly so developing one can help bring investors on board when looking for support or loans from banks and other lending institutions. The more detailed your plan, the higher your chances of securing funds successfully.

The following are some items often included in typical business plans:

Products – What will you offer? What is the market size? How much profit will each product yield after the cost of goods sold has been deducted (i.e., the cost for materials needed to produce your product)?

Market research – How much demand is there in the marketplace? Who are your competitors? What will happen if you open a store and no one shows up?

Financial projections – Does this business make money or lose money (i.e., how many customers will buy, what their average purchase price is, which expenses might be incurred during the operation of the business)?

The following are some items to include when conducting market research:

What is the demand in your target marketplace? Who are your competitors? What will happen if you open a store and no one shows ups?

How much profit can each product yield after the cost of goods sold has been deducted (i.e., the cost for materials needed to produce your product)? How many customers might buy from this business on an average day, week, or year?

Consider these questions as you come up with an idea of what products would be offered.

Before investing time and money into starting up any new business venture, it’s helpful to do some preliminary homework. A good plan can help set expectations about how long the process may take and what it will take to make the business successful. It can also help you figure out whether or not your idea is worth pursuing.

Business Bank Account

Before you start a business, you should first establish a business bank account. You will need this to deposit money coming in from your customers and expenses, as well as for any other accounting purposes you may have.

There are many kinds of financial institutions out there—some with higher interest rates than others or ones that offer special perks like student discounts on their checks, even if you’re not enrolled at that university. Some people prefer debit cards while some swear by credit cards; take time to research the best option for your needs before deciding on one particular banking institution.

As an entrepreneur starting, it’s also important to start saving now so that you’ll be prepared for the time when you inevitably run into financial difficulties.

When it comes to paying for things, one of the best options is receiving payments via credit cards or debit cards and then depositing them immediately into a checking account. You’ll be able to avoid any overdraft fees this way as well! If that’s not an option for you, there are many payment services available that allow merchants to accept multiple forms of payment including Paypal, Square Up, even ApplePay. It can get costly though so do some research first before deciding on what kind of platform will work best with your needs and budget.

Legal structure

The legal structure of your business will determine how you are taxed, what kind of employee benefits you have access to, and how ownership is divided.

At a minimum, there are three types of incorporation: sole proprietorship, partnership LLC or LLP (limited liability company), corporation.

Incorporating as a Sole Proprietor allows an individual unlimited personal liability protection when starting their own enterprise; this means that if they fail then all assets go into bankruptcy. This type of structure also does not require any licensing requirements and can be done with just one person owning it. If the owner dies or becomes disabled then shares may transfer to the new owners who would need approval from other shareholders.

Partnership LLC or LLP (limited liability company) is one option for a legal structure as it provides some personal protection from liabilities and requires licensing. The business has to have at least two owners who are not married, cannot be members of any other partnership, and can choose if there will be more than fifty percent ownership interest in the entity.

Corporations provide limited personal liability protection because owners only own shares which allow them to borrow money but do not guarantee their assets; they also require licenses before starting operations. Corporations can authorize stock with voting rights that may transfer without approval from current shareholders when an owner dies or becomes disabled while single-shareholder corporations do not have this requirement.

No matter what type of legal structure you choose, it is important to determine your company’s specific needs before deciding on one. For example, if you’re looking for more personal protection than a sole proprietorship provides then partnership LLC or LLP (limited liability corporation) may be best; alternatively, corporations can provide easier access and grant certain limited protections from liabilities that other types do not offer without additional costs associated with obtaining licenses.

Start a Successful Business Today with Messenger Bot

Successful businesses require a clear and achievable business plan. One key aspect of any success is customer satisfaction, which can be gained through the use of technologies such as Messenger Bot for your company’s online chat needs.

Facebook Messenger bots are designed to help users communicate with companies easily and efficiently that would typically require them to enter their email address to sign up for services or downloading apps that may not work on all mobile devices like iPads. There’s also no need to build another platform from scratch when you already have one where people spend more time than ever before; this means they’re most likely going to use it so long as there is something useful provided by the service available 24 hours per day.

Businesses that are looking to gain customer satisfaction and grow their audience should consider using Facebook Messenger bots for all of their online communications needs. It will help them reach a larger market, connect with customers who may not want to download another app just for your company’s service, and provide an additional convenience factor that most people would appreciate when they require assistance from you as the business owner or representative.

One way companies could use Messenger Bot is through it being embedded on a website so visitors do not have to go elsewhere if they don’t want to; there’s also no need to change any features since chatbots work seamlessly across devices like laptops, phones, tablets.

Setting up an online store is also possible with Messenger Bot. This means a user can buy or sell items with less hassle and without having to download apps that may not work for certain mobile devices.